SEPAmail DIAMOND offers the ability to verify the bank account information that an account holder provides to a payment originator of a transfer or direct debit.

SEPAmail DIAMOND detects data entry errors, fight against bank details fraud and ensures the reliability of data processed by payment originators. The App helps to reduce the number of rejected orders and erroneous fund allocations that can occur when payments are made using incorrect data.

How does it work?

This service is designed for payment originators who are either payees (checking the client’s bank account details before issuing a direct debit) or payers (checking the beneficiary’s bank account details before making a transfer).

SEPAmail Diamond can be used to:

- detect data entry errors by checking the IBAN format is correct

- detect if the IBAN is real and corresponds to an open bank account

- cross-check the IBAN against the presupposed account holder

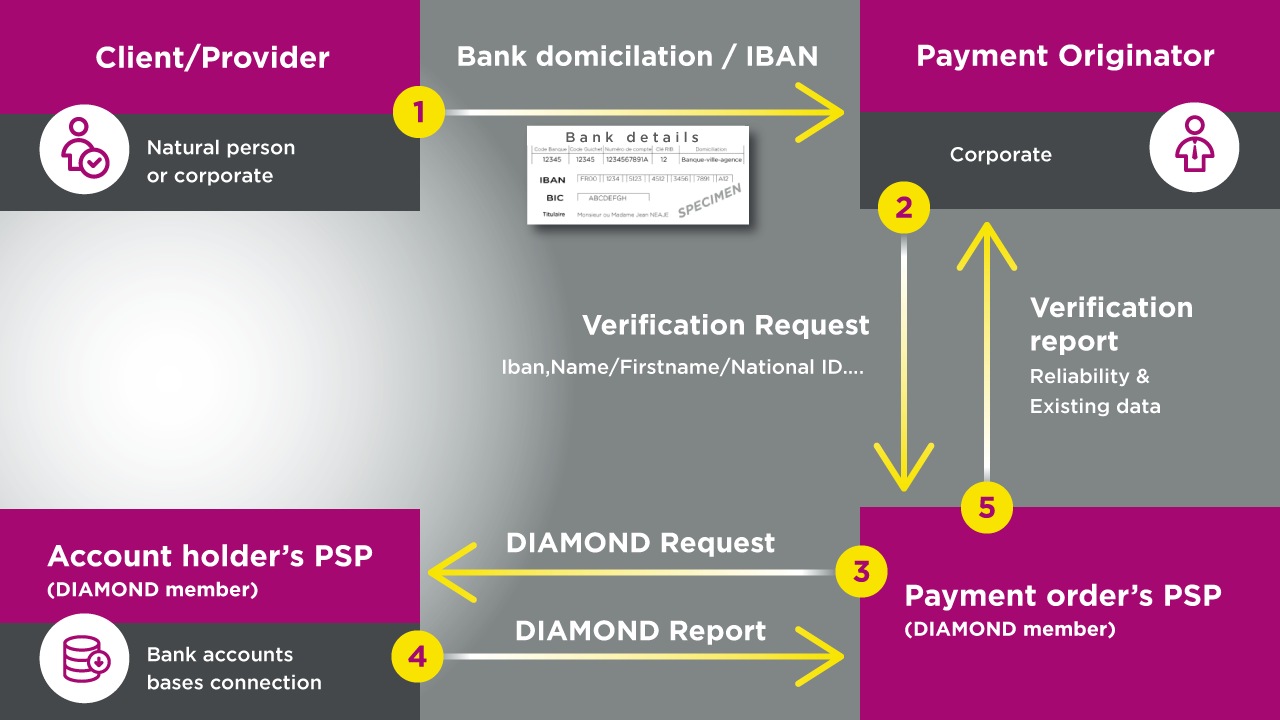

- The account holder provides their bank account details to a payment originator for a bank transfer or direct debit.

- The payment originator provides its PSP (Payment Service Provider) with the account holder’s bank account details for verification.

- The PSP’s payment originator sends the verification request on the bank account details to the account holder’s PSP.

- The account holder’s PSP uses a community algorithm to cross-check the data in the request with its own data. It then sends a verification report back to the payment originator’s PSP.

- The payment originator’s PSP sends this report to the payment originator in whatever format they had previously defined.